Product updates

Introducing Get Paid: Helping SMBs Take Control of Cash Flow

Alexander Segerby

Co-founder & CPO

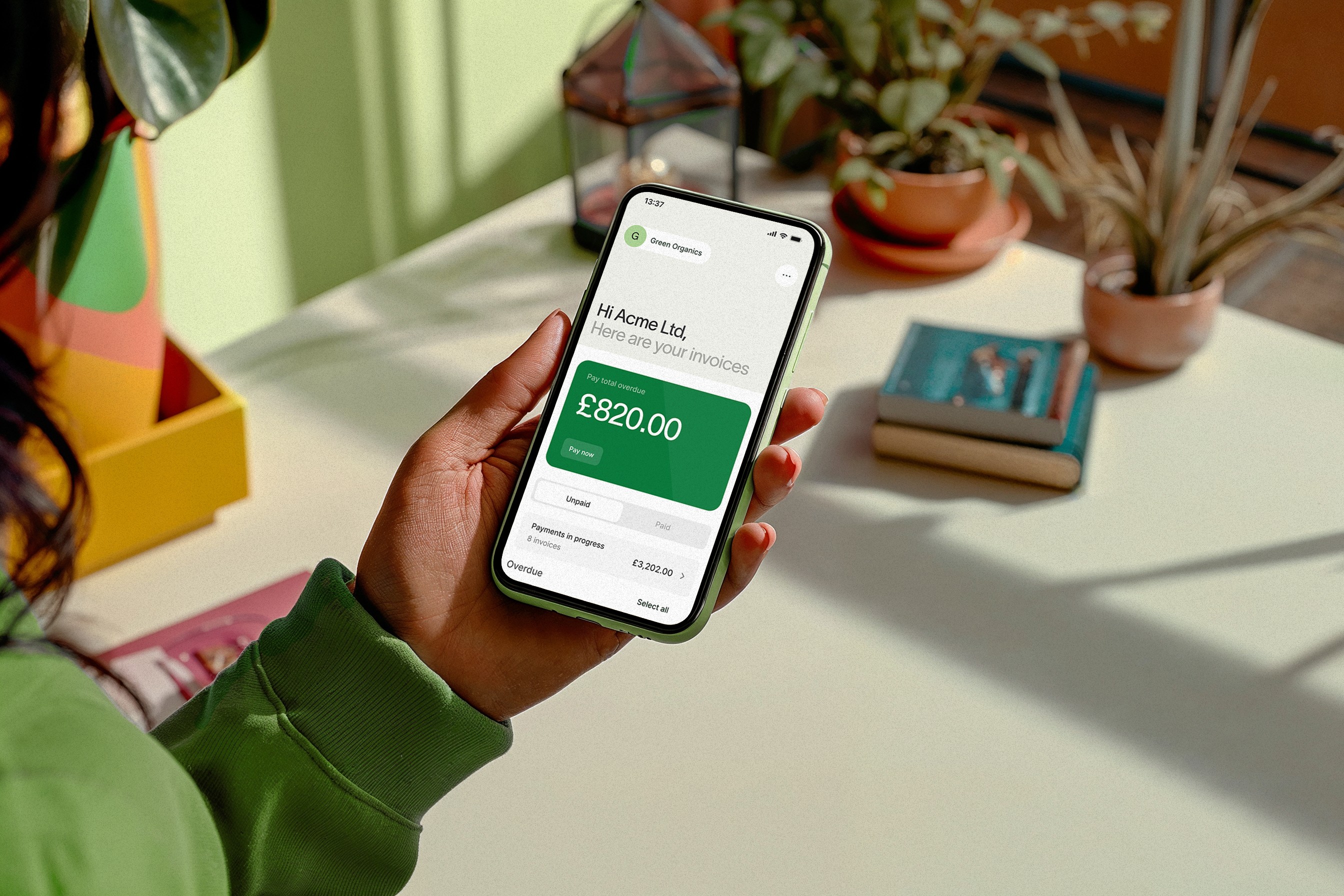

Get Paid complements our existing Mimo Pay Accounts Payable (AP) tool, creating a seamless platform that manages both sides of cash flow—making payments faster, easier, and stress-free.

We’ve built Get Paid with one goal in mind: to make getting paid simpler. By automating key tasks like payment reconciliation, sending payment requests and reminders, and offering flexible payment terms, Get Paid helps businesses avoid the hassle of tracking down payments and instead focus on growth.

Tackling Cash Flow Challenges for SMBs

Over the past few years, the number of SaaS tools for SMB finance has multiplied, offering solutions for specific tasks like payroll or invoicing. But this fragmented approach often leaves businesses juggling multiple tools, making it difficult to manage cash flow smoothly. For many SMBs, these gaps lead to delayed payments, with UK businesses alone owed an average of £22,000 in late invoices—directly impacting their ability to operate and grow.

At Mimo, short for Money-In, Money-Out, we’re on a mission to simplify financial management. By providing a single, comprehensive platform, we help SMBs and finance professionals manage cash flow effortlessly. Our platform is already processing millions in payments monthly, helping businesses reduce complexity, manage cash flow better, and ultimately get paid faster.

A Unified Platform Built for SMBs

Since our founding in 2023, we’ve been dedicated to helping SMBs navigate the complexities of finance. Mimo provides tools that streamline payments, working capital access, and cash flow management, serving sectors like manufacturing, professional services, and wholesale.

With offices in London and Stockholm and a growing team of 16, we’re committed to helping SMBs take control of their finances and unlock their growth potential. We’re proud to work alongside hundreds of SMBs and finance professionals each month to ensure they have the tools they need to succeed.

For businesses looking to take control of cash flow, Get Paid is here to turn complex financial processes into efficient, manageable steps—all in one place.

/ Alexander Segerby

Co-founder & CPO